Australia stands out as a leader in the rapidly evolving world of financial technology, particularly with the rise of digital wallets. These virtual payment systems are redefining how Australians engage with their finances by offering seamless, secure, and efficient transactions. As we look towards the future, it’s clear that Australians are not just adapting to digital wallets—they are pioneering changes that could reshape financial transactions on a global scale.

The increasing popularity of digital wallets in Australia reflects a national culture that values speed, security, and convenience. Australians have a reputation for quickly embracing new technologies, and digital wallets are no exception. The country’s robust digital infrastructure has made these transactions easier and more accessible, providing a range of payment options that simplify everyday financial interactions.

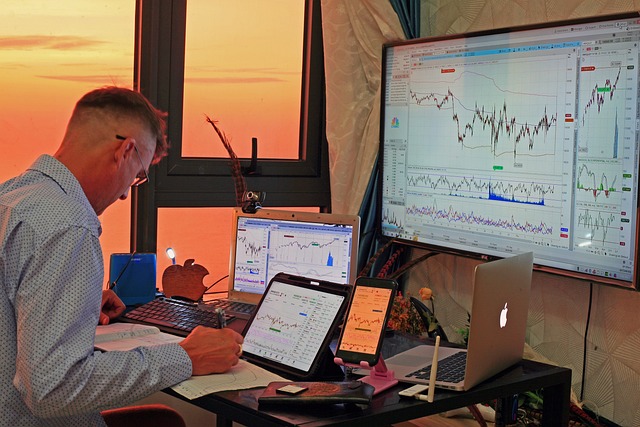

One of the most compelling aspects of digital wallets is the convenience they bring to everyday transactions. Whether it’s buying a cup of coffee or booking movie tickets, digital wallets offer a level of ease that traditional payment methods struggle to match. This convenience extends into the world of forex trading as well, where digital wallets enable swift and easy currency exchanges. Traders can quickly deposit funds into their accounts or withdraw their earnings, streamlining the trading process and making it more efficient and engaging.

Security is another area where digital wallets excel. In an era where cyber threats are a growing concern, the advanced security features offered by digital wallets are highly valued by Australians. From real-time monitoring to biometric authentication and encrypted transactions, these features provide a robust defense against fraud. For forex traders, this added layer of security means they can focus on their trading strategies without worrying about the safety of their funds.

The integration of digital wallets into the forex trading environment highlights their versatility. Beyond enabling instant money transfers, digital wallets also offer currency conversion capabilities. This is particularly advantageous for traders dealing with multiple currencies, as it simplifies the management of their financial assets. In the fast-paced world of forex trading, where speed and efficiency are crucial to profitability, the ability to quickly convert and transfer currencies is a significant advantage.

Looking ahead, the potential for digital wallets in Australia appears boundless. The rise of blockchain technology and the growing adoption of cryptocurrencies are poised to take digital wallets to new heights. Innovations like peer-to-peer transactions and faster processing times are expected to further enhance the efficiency of these systems. For forex traders, the integration of cryptocurrencies and blockchain technology into digital wallets could revolutionize the management of trading funds, enabling even quicker transactions and reducing costs.

However, the widespread adoption of digital wallets does come with challenges. Addressing regulatory hurdles, privacy concerns, and the digital divide is crucial for the equitable and secure implementation of this technology. Australians are at the forefront of tackling these issues, supporting initiatives that bridge the digital gap, strengthen privacy protections, and clarify regulations. These efforts are essential to ensuring that all Australians can benefit from the advantages that digital wallets offer.

In summary, the future of digital wallets in Australia is not just promising—it’s already taking shape. Australians are leading this financial revolution, driven by their appreciation for the efficiency, security, and convenience of digital wallets. As these technologies continue to evolve, integrating new innovations and expanding their capabilities, digital wallets are set to play an increasingly central role in financial transactions, including forex trading. The rise of digital wallets is a testament to Australia’s innovative spirit and its ability to lead and adapt in the ever-changing landscape of finance and technology.